#1 - Bank Accounting; Magic?

Innocent Magic or Criminal? - [~15 minute read]

False Accounting and Deliberate Deception

My previous “Welcome” article made the extraordinary claim that bank “lending of credit” is a criminal enterprise, concealed by deceptive banking practices and based on false accounting. The extraordinary evidence required to prove that claim will come from statements of ordinary loan accounts provided by various Australian ‘lenders’. Three future articles deal with each of those ‘lenders’ in turn.1

If you have a bank loan, chances are you already have similar evidence in your hands right now, in the first statement of your loan account [Statement No.1], but you probably can’t see it. This is because the false accounting “trick” is so well concealed.

To discover the “trick” myself, I first had to recognize that magic was involved and learn how magic really works, then marry that knowledge with banking’s double-entry [DE] accounting, which was a real revelation for me. But that makes it hard to describe “the trick” without first discussing magic and then explaining how the trick is done in the bank’s own language (accounting), a language most people find totally off-putting.

So, if you’re not a professional accountant2, to understand the evidence I’ll show you in the next three articles, you’ll need to endure my Introduction to Accounting, below. I don’t apologize for this process; when you see how we can use that knowledge, you might even be inclined to share this article with friends you care about.

My ‘Public Exposure’ Plan

Banking does use magic and has done for centuries. It could not have reached its dominant position in world affairs without it. Controlling the issue of 97% of the worlds ‘money supply’ in the form of ‘bank-credit’, a global group of bankers is more powerful than any national government or combination of nation states.

Well, I’m not prepared to tolerate this situation any longer than it takes to demolish the magical façade behind which they hide their accounting trickery.

Widespread understanding of how they falsify their accounts is the perfect antidote to their ‘magic trick’, and exposure of it is the obvious remedy to its on-going concealment.

I plan to conduct this investigation in public and I have two objectives in this article:

First, to delve into ‘magic’, briefly, but sufficient to enable readers to recognize it in their lives. If you are being asked to believe the “impossible”, you are probably in its presence.3

Second, to lay out the rules of double-entry accounting which banks enforce on us, so we can at least return the favour and enforce the same rules on them. This will be our remedy.

In subsequent articles I’ll use those rules to examine several real bank “loan” account documents in which the elements of magical ‘creation of credit’ can be identified precisely.

You will see how banks fraudulently pull this “invisible money” out of their “empty asset account” hats and get away with charging interest on it, as though it was a “loan”.

MAGIC

What do magicians do? They create illusions. How do they do it? By lies, deliberate deception and casting of ‘spells’.

Stage magicians must distract the audience from what is actually happening and they do that by falsely describing what they want you to believe is happening, namely something apparently “impossible”. Since the “impossible” is just that (viz., impossible!) their stage patter is deliberately deceptive and misleading.

False, misleading words, spoken with confidence, are the secret ingredient of most stage ‘magic’. Instead of saying, “I am about to deceive you …”, the magician says, “Prepare to be amazed …” and proceeds to describe the illusion he wants you to believe you are about to witness, mentally conditioning you to accept that something impossible is about to happen.

Bankers are not stage magicians, however, and don’t rely on fancy ‘stage props’ or ‘smoke and mirror’ gimmicks.

Their magic is in their words.

Here’s a simple example of mental conditioning by use of a word-spell. It makes an ambiguous request about four ‘words’, each of which is a false description of the colour you are asked to ‘say aloud’.

Be honest. Did you get it right the first time? These words easily over-ride their actual colour; it’s that simple.

Words (which are always ‘spelled’) connect your ‘mental machinery’ to the world of objects and concepts and words, carefully chosen, can manipulate or even control your ‘machinery’, unless you are aware of such techniques and guard against them.

Never shout “FIRE!” in a crowded theater. People react instinctively to such emotive words. Strike an emotional key and your words can work ‘magic’. The ‘imaginary’ (fire?) can become all too ‘real’ for your audience.

When people become ‘immersed’ in a speaker’s narrative, they are like a ‘fish in water’. The speaker can ‘guide’ the ‘fish’ by controlling the ‘flow’ of the ‘water’ (i.e., the ‘stream’ of their words).

And if you can convince people that your words describe “reality” then you can make the “impossible” seem possible. It really is that simple. This is what banks have been doing these past 5,000 years.

Who would ever have suspected that bank “trickery” would be based on their WORDS, when their accounting business seems to be all about NUMBERS?

Confusing Words? … Don’t do it!

When I point to evidence of bank crimes, I want it to be so clear that it can be quickly recognized for what it is. In this arena, ambiguity is my enemy.

In that vein, please resist the temptation to call ‘credit’, just another form of money. Distinguish “cash” and “credit” clearly. The first I call “hard money” or simply ‘money’; the second, “invisible money”. I’m not discussing their respective merits here; I want to ensure proper access to both. Just note that “money” is a banker’s nightmare; it competes directly against their product, “credit” (why else would they be trying to abolish it?) and the difference is critical.

“Credit” plays the starring role in this analysis, so understanding it in the context of banking needs to clear. A rigorous definition avoids ambiguity.

The meaning of “credit” changes when used as an adjective, verb or noun and, of these, the most ambiguous is the noun. Try not to use the noun, to avoid explaining which of its many meanings you’re using.

The least ambiguous are the adjective and the verb, but the verb poses a simple riddle which we need to master. Like the Roman god, Janus, it ‘has two faces’ looking in opposite directions (i.e., two opposite meanings): it means ‘add’ in one context and ‘subtract’ in a different context. To add complexity to the riddle, the same pair of opposite meanings in reverse order apply for the matching verb “debit”.

So, it’s no surprise this Janus-like aspect confuses even the best finance-journalists and economists (OK! I’ll admit it) or engineers. We’ll see below how My Six Accounting Rules deal with this riddle of “opposite meanings” so we can be the master of both verbs, “debit” and “credit”.

My aim is to create a solid foundation of well-defined words and unambiguous rules which should short-circuit arguments over terminology.

INTRODUCTION TO ACCOUNTING - Accounting Words

Here’s a list of terms used in banking and my brief comments on each:

T-Accounts;

Debit [Dr] & Credit [Cr] (as adj., v. and n.);

The Matching Principle (the basis of double-entry [DE] accounting);

The Accounting Equation (simplified);

Balance Sheet; Asset & Liability accounts;

Creditor & Debtor on the Same Account; and

Typical “Loan” and “Access” account features.

T-Accounts: Every bank account has at least 5 columns, as in Figure 1. It’s called a T-account due to the T-shape separating Debits and Credits.

Debit [Dr] & Credit [Cr]: I advise novice readers to follow my accountant’s advice to forget about the noun and verb initially, and treat these as a pair of opposite adjectives, just like left and right. I’ll deal with the double-meaning riddle of these Janus-verbs in detail below.

The Matching Principle (or DE Process): Every bank transaction must be recorded (at least) twice, once as a debit-item and once as a matching credit-item, and the entries must be equal. For complex transactions, when more than one Cr- or Dr-item is needed, the sum of the Cr’s and the sum of the Dr’s must be equal. Example4: $10,000 cash received as a loan gives you a new Asset (Cash) and a new Liability (Loan payable). This single ‘loan transaction’ is recorded (i) as a debit-item of $10,000 (increasing the debit-balance in your Cash Asset a/c), and (ii) as a credit-item of $10,000 (increasing the credit-balance in your Loans Payable Liability a/c). The entries in your general ledger (or journal) would be:

Accounting Equation: ASSETS = LIABILITIES [+ owner’s equity]. This equation must be true at all times. I’ll ignore “owner’s equity” in these articles. It plays no part in granting a “loan”5.

Balance Sheet, Assets & Liabilities: Like the Accounting Equation, a bank’s Balance Sheet has two sides, which separate the two TYPES of Account:

what a bank owns & is owed6, recorded in Asset accounts [on the LH side]; from

what a bank owes, recorded in Liability accounts [on the RH side].

Creditor and Debtor on the Same Account: Every account describes a relationship between two parties: a Creditor and a Debtor. Which is Creditor and Debtor will be clear from the context, and what it represents depends on which party is looking at it.7 While the Creditor sees it as their Asset a/c, the Debtor sees the same account, simultaneously, as their Liability a/c. So, we need to be clear whose perspective we are using. Unless otherwise specified, I’ll adopt that of the “bookkeeping lender”.

Just remember, while the books belong to the bookkeeper, the numbers and words in them should truthfully represent the interests of both parties (seen from opposite perspectives).

Typical “Loan” and “Access” account features: When a bank grants a “loan” the Matching Principle is applied to two newly-created accounts, both having the customer’s name and address on the top as well as the Bank’s identification marks. They are usually called the “Loan a/c” (with Dr-balance) and “Access a/c” (or similar), where the new “loan funds” appear as a Cr-balance.

The “Loan account” is a bank’s Asset account. It shows what the customer OWES the bank, as a Debit-balance [see RULE 3, below]. That same account is also the customer’s Liability account, showing the customer’s obligation (liability) to pay the bank that amount.

In that case, the customer is clearly the DEBTOR and the bank is CREDITOR.

An “Access account” (or cheque a/c), is the bank’s Liability account, showing how much the bank OWES the customer, as a Credit-balance [RULE 3, again]. From the customer’s perspective, it’s the customer’s Asset account, showing the bank’s obligation (liability) to pay the customer when the customer asks for the funds.

In that case, the customer is clearly the CREDITOR and the bank is DEBTOR.

And that’s that.

Next, we focus on My Six Accounting Rules, the minimum needed to detect and correctly describe bank accounting fraud.

MY SIX ACCOUNTING RULES (with comments on each)

RULE 0: You know what happens if you break this rule, by drawing a cheque with inadequate funds in the account, right?8 If an a/c Balance = $0.00, (and you don’t have an “overdraft agreement”)9 attempting to draw funds from it can be regarded as attempted fraud. Well, since banks have no pre-existing “overdraft agreement” with us, we can apply the same rule to them!

RULE 1: This is my simplified Accounting Equation and must be true at all times.

RULE 2: [for T-accounts] See Figure 2 or 3, above, for examples. If a bank ever violates RULE 2, it will be using alternative headings, like “Withdrawals” and “Deposits”, in their T-accounts. [Believe it of not, magic can happen here!]

RULE 3: [for T-accounts] This pair of definitions provides a foolproof way of identifying the two TYPES of Account - ASSET and LIABILITY - based on the TYPE of Balance [Cr or Dr] shown in its far right column.10 Note that:

RULES 4 & 5: [for T-accounts] In the beginning, it might pay to focus on learning only 4a & 5a [“what increases what”]. Once you master those, 4b & 5b [“what decreases what”] will come naturally.

These two rules serve two purposes:

They solve the riddle of the opposite double-meanings of our two Janus-verbs, ‘debit’ and ‘credit’, so we know when to use addition and subtraction, and

When the TYPE of Balance is not immediately obvious, they can identify the TYPE of Balance, so we can then apply RULE 3 to identify the TYPE of Account.

With apologies to the Mission: Impossible ‘voice-over’ guys, “Your mission, [Insert your name], should you decide to accept it, is to find a way to learn these 6 RULES which works for you. They will NEVER self-destruct and can be used forever.”

For accounting gurus, the next part is optional.

I include it to help accounting novices master the riddle of the verbs “debit” and “credit” in the context of the matching principle, when double-entries occur. If you are not on top of this riddle and understand how to master it mentally, you won’t understand the MAGIC when it HAPPENS HERE.

MATCHING PRINCIPLE, DOUBLE-ENTRIES and ‘MAGIC’

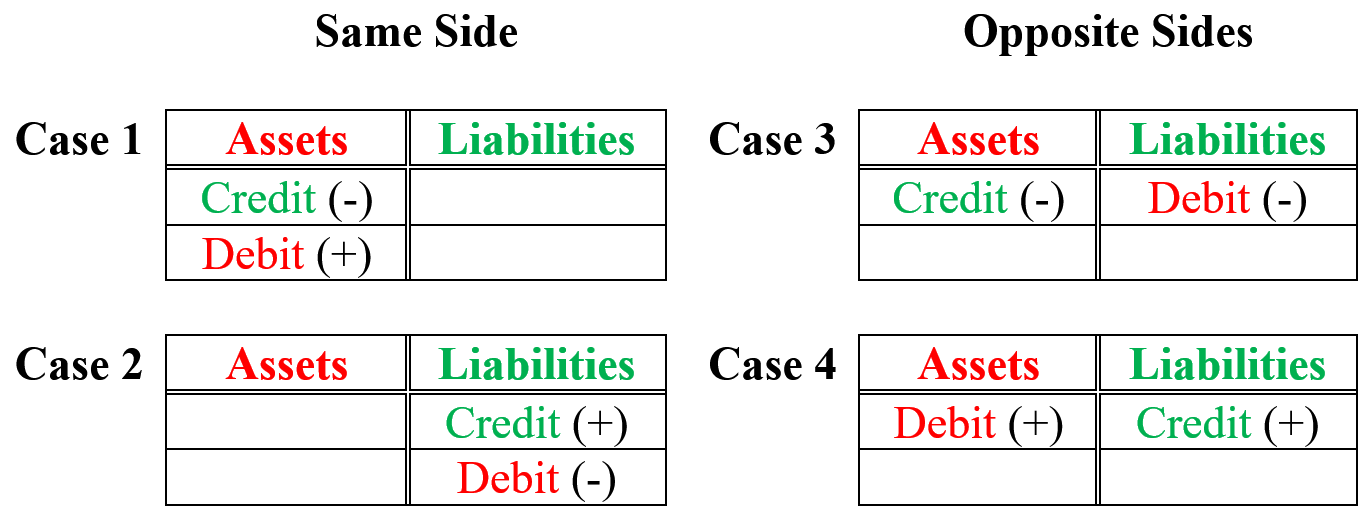

There are four ways to put matching pairs of debit- and credit-items on a two-sided Balance Sheet (see Figure 5, below), viz.:

matching credit & debit can go on the Same Side (Cases 1 & 2); or

matching credit & debit can go on Opposite Sides (Cases 3 & 4).

Note that the colours and the (+) and (-) signs show how RULES 3, 4 and 5 work. Study the colour patterns and the ‘+’ and ‘-’ signs and you will see that,

when the colours in a column match, (e.g., Case 4), there’s a ‘+’, and

when the colours in a column don’t match, (e.g., Case 3), there’s a ‘-’.

This summarizes the mathematical ‘flip-flopping’ of the verbs credit and debit, which can mean either ‘add’ or ‘subtract’, depending on the side of the balance sheet they are on. This is the reason why DE accounting works and the Accounting Equation should balance. I explain it as follows:

When the matching credit and debit are on the same side of the Accounting Equation (as in Cases 1 & 2), they have opposite signs (+,-) or (-,+), and cancel each other’s effect, so the Total on that side of the equation remains unchanged.

When the matching credit and debit are on opposite sides of the Accounting Equation (as in Cases 3 & 4), they have the same sign (+,+ or -,-), and the Totals on each side either increase by the same amount (Case 4; +,+) or decrease by the same amount (Case 3; -,-), so the equation again remains balanced.

I hope my RULES simplify the Janus-riddle for you and help you identify “mistakes” in any type of T-account.

In cases we will be examining, a single “loan transaction” is (or should be) recorded as matching debit- and credit-items on opposite sides of the balance sheet, like Case 4 (+,+) in the above or in Figure 3 (under the heading “The Matching Principle …”).

Investigation Skills

To follow the investigations in the next few articles, you really need just two basic accounting skills, viz., The ability to:

IDENTIFY the TYPE of Account, i.e., whether it’s an Asset or a Liability a/c, based on its Dr- or Cr-Balance column [RULE 3] (or else DEDUCE the TYPE of Balance from the effect a Dr- and Cr-item has on a previous balance, using RULES 4 & 5, then apply RULE 3 to identify the TYPE of Account); and

RECALL the correct mathematical operations for Cr- and Dr-items in either an Asset or a Liability account [RULES 4 & 5 again].

This is the heart of what you need, so you can follow the analysis of actual bank accounts, using my “strict accounting” approach. If you follow these RULES, you may even be able do your own forensic investigation of your own “loan” account(s). If you do, I’d be very interested in what you find.

Let me know in Comments if any aspect of this article is still not clear. If you see a mistake, I also want to know about that, so I can correct it.

If you like what you’ve seen here, please share it. The more people who understand what bankers are actually doing, the sooner we regain our correct relationship with them and with our credit (i.e., as Creditors).

I’m not charging for access to this information at present but your free subscriptions do give me useful feedback.

Now that you understand their accounting language and have a set of RULES to apply to THEM, in the next few articles we can start dissecting actual accounts of real people to identify and explain the “tricks” banks adopt to perform their ‘magic’.

When this is done is precise accounting terms, there will be little room for them to manoeuvre.

One is a credit union and two are well-known Australian banks.

If you are an accountant, I’d really appreciate your criticism or positive comments.

All ‘magic’ is illusory. Magicians cannot ‘defy nature’. Deception is the key. I’ve never witnessed what would be regarded by experts as a ‘miracle’, and as far as I can tell, natural laws do not ‘break’, no matter how hard magicians try to bend or get around them.

This example is from the perspective of the borrower (not the lender).

Sentence edited (23-09-23) to remove incorrect statement about equity being a special class of Liability.

Added “& is owed”, following a comment by @ECONOMICS21ST, who’s developing a new way of looking at economics which shows great promise.

Opposing perspectives are also the basis of the riddle that arises with the verbs ‘debit’ and ‘credit’’. It’s like a highway, which does NOT have a LH- or RH-side, until a person travels on the road facing in one direction (or the other). As soon as she does a U-turn, the side that was previously the ‘LH-side’ (for her) becomes the ‘RH-side’ (and vice versa). On-coming traffic sees exactly the opposite ‘handedness’ at the same time.

Your cheque will be dishonoured, payment stopped, and a very substantial penalty charge will be deducted from your account balance.

An “overdraft facility” may seem to breach this rule if the account becomes overdrawn. But, in accounting, this event changes the credit-balance to a debit-balance and, accordingly, the account ‘moves’ from the Liability side to the Asset side of the Balance Sheet [by RULE 3]. “Clearing the overdraft” simply changes it back to a credit-balance, reversing that ‘move’, following RULE 3 again.

The wording of these definitions can also be reversed, e.g., A Debit-balance ALWAYS identifies an Asset a/c, etc.

When I first read about bookkeeping as a teenager, one of the things which confused me was the insistence that debits must equal credits for a given transaction. E.g. if a firm buys a delivery van for $20,000, it credits the "cash" account by $20,000 and debits the "vans" account by $20,000. But what if it had been offered a 10% discount? Its "vans" account would have an $18,000 debit. Are the vans somehow worth less because the firm didn't have to pay as much for them?

Now I understand that some of accounting, particularly valuation, is accounting convention, which is corrected over time (e.g. by depreciation, or sale of the van). For economic modelling, I've started using the idea of "raw net worth": not assigning monetary values to everything. So when a firm buys a van for $20,000, it loses a $20,000 asset and gains a van asset. It's not appropriate for accountancy, which must assign a fair value to a firm, but it's a much more direct model of what is actually happening, making it work very well for economic modelling.

I also split transactions into individual actions (each represented by a coloured arrow). So buying a van is 2 actions: (1) transfer of $20,000 from the firm to the seller, which decreases the firm's raw net worth by $20,000, and (2) transfer of the van from the seller to the firm, which increases the firm's raw net worth by the van.

(If you're in the mood for a slight complication, there are actually 2 more actions: (3) decrease in firm's equity by $20,000, and (4) increase in firm's equity by the van).

Phew! That's a lot to digest... I think I'm with you so far.