#2 - ANZ Bank Loan Accounts; Deconstructed

Account Falsification by ANZ Bank (~20 minute read)

This is my first article exposing evidence of accounting fraud by lending institutions in Australia, customers of which are happy for their records to be published anonymously.

The RULES

Readers unfamiliar with ‘magic’ or double-entry accounting should read #1 - Bank Accounting; Magic? to brush up on my six basic rules of double-entry accounting, before they proceed. If you can’t remember these rules, what you are about to read will make no sense. I’ve included Figure 4 from that article here for reference, and it may be more helpful if your can print a copy of it and keep it handy as you read this and following articles.

The EVIDENCE

ANZ Bank “Loan” Accounts

This article exposes evidence of accounting fraud by the ANZ Bank. The bank customer involved is allowing his records to be published anonymously; I’ll call him “Bill”.

Since there is nothing special about Bill or his accounts, I believe if I looked at any similar ANZ BANK customer’s loan account statements I’d see the same evidence. I’ve already seen similar evidence in documents from several other “lenders”.

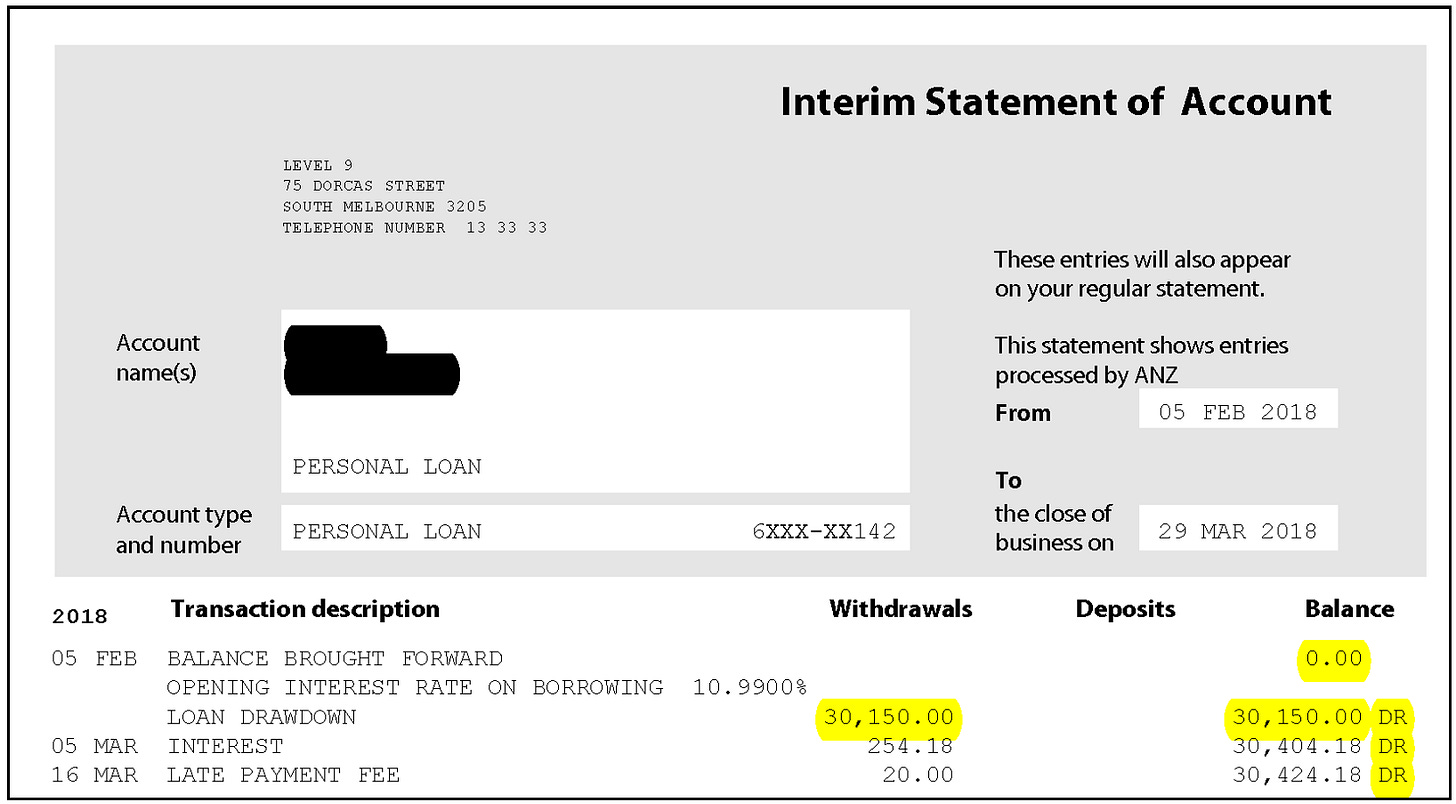

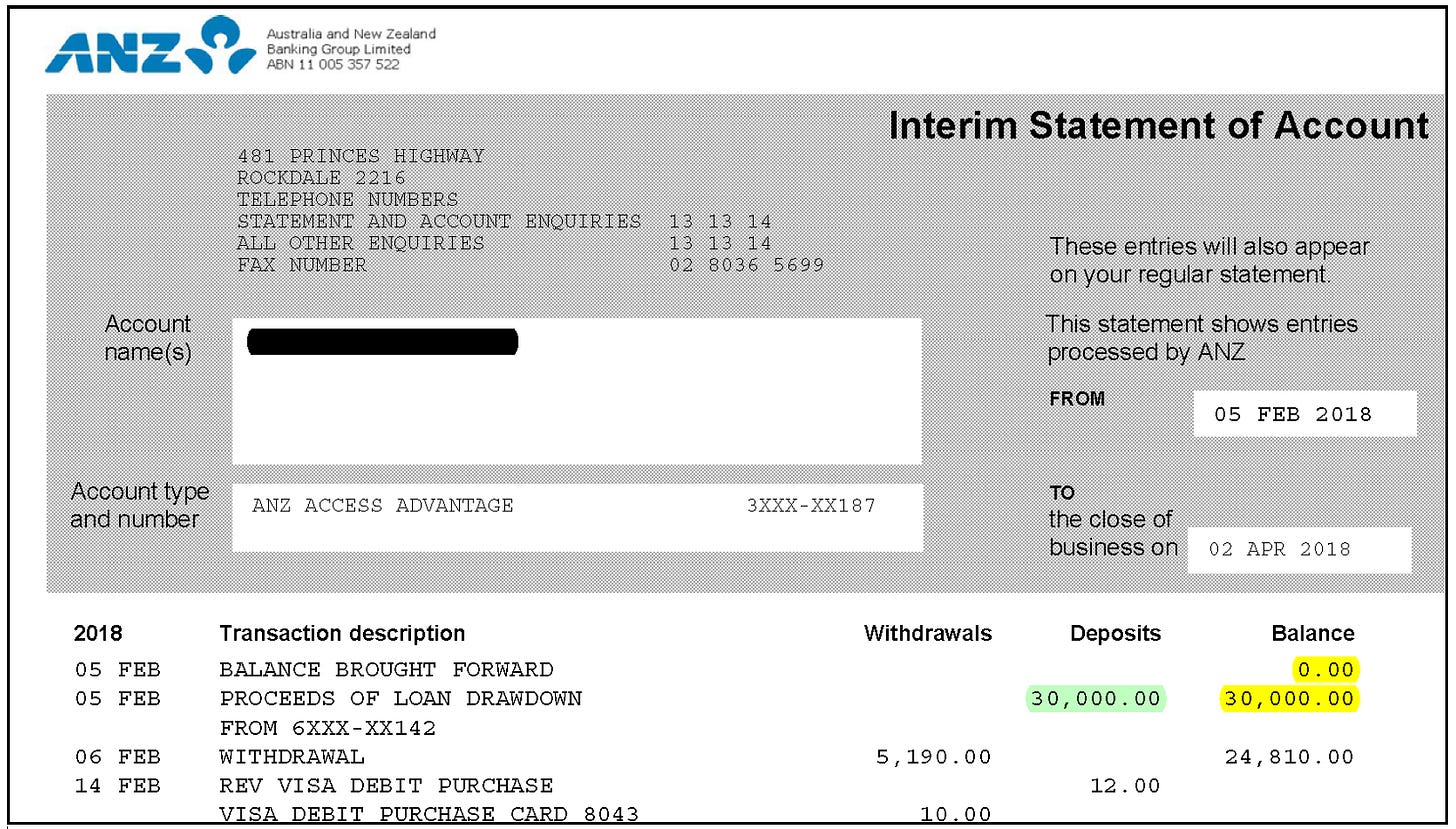

In Figure 1, Bill’s Personal Loan a/c [LH panel] and ANZ Access Advantage a/c [RH panel] are shown in full, with name, address and some transaction details redacted, and account numbers partially redacted, to ensure privacy while maintaining accuracy. I’ll focus on Column Headings and the first three lines in these pages, where the incriminating evidence is presented by the bank itself.

Case Details

On 5th February 2018, Bill took out a $30,150.00 loan. A Loan Application Fee of $150.00 was to be deducted, so only $30,000,00 was available as “credit”. ANZ Bank’s account of this process is given in the first three lines of the LH panel, in the following words and numbers:

[Line 1] “05 FEB [2018]: Balance Brought Forward … 0.00”; [Line 2] “Opening interest rate on borrowing 10.9900%”; and [Line 3] “Loan Drawdown … 30,150.00”, placing that number under the heading “Withdrawals”, and giving a new Balance of “30,150.00 DR”.

“Credit-creation” occurs in the RH panel [Lines 2 & 3], as follows:

[Line 1] “Balance Brought Forward … 0.00”; [Line 2] “Proceeds of Loan Drawdown [Line 3] from [Account No.] 6XXX-XX142”, and Bill’s “30,000.00” of “credit” appears under the heading “Deposits”, and again as the “Balance” of “30,000.00”.

The evidence of accounting fraud is now in front of you, but don’t worry if you can’t see it yet; the whole world appears to be under the same hypnotic trance at the moment. It’s my task here to break that trance.

Forensic Examination

Account Types

We can determine which of these is the Bank’s Asset account and which is the Bank’s Liability account with RULE 3, checking the type of Balance in each, i.e., Debit [Dr] or Credit [Cr]. As the Personal Loan a/c extract (Figure 2, below) has “DR” (yellow) after all Balances, it’s undoubtedly the ANZ Bank’s Asset a/c.

In the extract from the Access a/c (Figure 3, below), the “30,000.00” (green) item in the RH Credits column caused the “0.00” (yellow) balance to increase to “30,000.00” (yellow). By RULE 5a we deduce that it’s a Cr-balance and therefore, by RULE 3, the Access a/c is the ANZ Bank’s Liability a/c.

Can you see it, now?

Notice immediately that both accounts have identical centre column headings, viz., [LH] “Withdrawals”, [RH] “Deposits”.

The first question to ask yourself is, “Can these column headings be correct in both accounts?”

[Answer provided below.]

A “Magic-Carpet” Interlude

As a mental conditioning exercise to weaken the prevailing hypnotic trance, I’ve spun two yarns (below), both entirely fictitious but based on the above extracts. With this warp and weft I’ll weave a Magic Carpet. (Refer to Figures 4 & 5, below).

The Bank’s Story (the warp)

[05 FEB 2018: Bill arrives to finalize his loan, as previously discussed …]

Bank: “Good morning, Bill. You’re ready to sign the Loan Agreement today?”

Bill: “I guess so. I understand I’m paying a $150 Loan Fee, right? I get $30,000 credit in my Visa card account, but all up I’ll owe the bank $30,150. Is that right?”

Bank: “That’s right, Bill. First, we’ll open your Personal Loan a/c and withdraw the full $30,150. We’ll deduct $150 as our “Loan Fee” from that drawdown and deposit the balance of $30,000 as a Credit into your Access Advantage a/c. Your Visa Card can draw from that.”

Bill: “OK. Where do I sign?”

Bank: “Right there. ... Good, thank you. Here’s your Visa card. You’ll be able to withdraw funds from your Access a/c first thing tomorrow.”

In Figure 4 [Line 3] you can see the “Loan Drawdown” (red) of “30,150.00” posted under the column heading “Withdrawals” (red) from the Personal Loan a/c No. “6XXX-XX142” (green).

In Figure 5 [Lines 2 & 3] you can see “Proceeds of Loan Drawdown from” (red) “6XXX-XX142” (green) of “30,000.00” posted under the column heading “Deposits” (red). We see $150 has disappeared, as agreed, and everything is exactly as the Bank said.

However, two months later ...

Bill’s Story (the weft)

[2 APR 2018: On reading his first bank statements, Bill returns to the bank, seeking explanations …]

Bill: “I see your assets increased from $0.00 to $30,150.00 when you opened these accounts, so why did you put “Withdrawals” on the LH column, above my $30,150 deposit? That should be “Deposits”, not “Withdrawals”. That transaction represents the value of the loan agreement I deposited in the Bank, doesn’t it?

Bank: “Errr, umm, . . . Yeah . . . it does.”

Bill: “Incidentally, how could you “Withdraw” funds from that a/c? Before my Deposit, that a/c was EMPTY. If I tried that in my cheque account you’d have stopped payment, dishonoured my cheque and hit me with a $150 penalty for attempted fraud, wouldn’t you? I’d be lucky if I wasn’t arrested.”

Bank: “Well, yes we would . . . but not the arrest thing. Anyway, it’s different with your Loan Account. You see, we have a banking license and can do things like that.”

Bill: “We'll see about that! And by the way, if there was a “withdrawal” on the 5th of February, I’d see a Credit-item there, but there’s no Credit-item anywhere in that loan account. Your assets went up, not down. I’m calling BS on this whole scam. The police might like to see those accounts too, so keep them handy, will you?”

Bank: “Now wait a minute Bill. Let me get you a coffee. I can explain ... ”

Unpicking the Magic Carpet

These narratives are intended to sensitize you to the fact that there are two intertwined ‘threads’ in the Bank’s two statements; it’s a magical tapestry I’m laying out here.

The words on these statements (the warp) certainly match The Bank’s Story of withdrawing $30,150.00, keeping the $150,00 fee and depositing the balance of the loan funds (a $30,000 Credit) into Bill’s Asset a/c (a.k.a. the Bank’s Liability) a/c.

But the numbers on these statements (the weft) show Bill’s Story of depositing his $30,150 loan agreement in the Bank’s Asset a/c, forcing the Bank to raise two Credit-items [$150 + $30,000] to match that $30,150 Debit-item. As he sees no evidence of an asset being withdrawn from the Loan a/c, he knows nothing was deposited by the Bank in his Access a/c.

Knowing accounting rules, Bill can see that the Bank has lied to him in their words (i.e., “statements”). What you should now be able notice clearly is how The Bank’s Story relies on a “narrative”, their words, both spoken in real-life, and written on the two documents, while Bill’s story relies on the “accounting”, told only by the numbers on the self-same documents.

The Bank has carefully wrapped apparently plausible but contradictory oral and written narratives around what the accounting numbers actually show, when seen as following the accepted rules and principles of double-entry accounting.1

For anyone unfamiliar with accounting rules, this magician’s device - narrative LIES - easily override the accounting TRUTH. If Bill was ignorant of accounting rules, he would probably remain entranced and become another victim of the global deception. And every “lender” seems to be running a slight variation of the above narrative, as we shall see in later articles.

Forensic Examination, continued

Now, back to the formal analysis. What accounting “errors” has the ANZ Bank made in recording this “loan”?

It appears to have broken two rules: RULE 2: “Dr on the LEFT; Cr on the RIGHT”; and RULE 0: an attempted withdrawal from an empty a/c.

But, as with stage magic, all is not as it seems … be prepared to be amazed.

“Errors” in Bank’s Asset a/c

LIE No.1 [Figures 4, 6]

In this Bank Asset a/c, using “Withdrawals” and “Deposits” (instead of “Debits” and “Credits”) for the LH and RH column headings, respectively, does breach RULE 2 and is a two-fold lie. This answers the “ask yourself” question, above, but the reasoning is complex.

Before I explain, I have another easy question for you: “Is a withdrawal a Credit or a Debit?”

[Write your answer down now and see if you got it right in a moment.]

If you withdraw $100 cash, a 100.00 debit appears in your a/c and is subtracted from the credit-balance [RULE4a], so your credit-balance goes down by $100. To account for that transaction, the bank must reduce the debit-balance in its own ‘cash asset a/c’. By RULE 5b it must subtract a 100.00 credit from that asset a/c. A withdrawal from your asset a/c [the bank’s liability a/c] as a 100.00 debit, results in a withdrawal of cash by the bank from its asset a/c (“cash”) as a 100.00 credit.

So, the correct answer is, a “Withdrawal” from any a/c is what reduces its Balance; it can be either a credit or a debit depending on which Type of a/c you’re looking at.

For a withdrawal to reduce the Debit-balance in its Asset a/c, the bank puts the item in the RH (Credits) column [RULE 5b], but

For a withdrawal to reduce the Credit-balance in its Liability a/c, the bank puts the item in the LH (Debits) column [RULE 4b].

In this instance, the Debit-balance increased from “0.00” to “30,150.00 DR”, the opposite of a ‘withdrawal’, and the “30,150.00” item also appears in the wrong [LH or Debits] column; for a ‘withdrawal’ it should be in the RH or Credits column of the Asset a/c.

From the documented fact [evidence] that the transaction amount was placed in the LH column of the Asset a/c, we prove that this transaction was actually a Deposit by Bill of an asset worth $30,150, not a Withdrawal by the Bank.

By RULE 2, the LH column is always “Debits”; and by RULE 4a, that Debit-item should increase the previous “0.00” Balance to “30,150.00 DR”, which it does. So either “Debits” or “Deposits” would definitely be the correct LH column heading and “Withdrawals” is both incorrect and misleading in this Asset account.

Switching both column headings in this a/c is a double-lie which creates an illusion of a withdrawal when there was a deposit. Since these headings describe the opposite of what happened, each column heading becomes a separate lie. This is fraudulent accounting.

Words are the crucial part of this account2 of a “$30,150.00 Deposit” transaction, more important than the numbers in this case.

The Bank has cast an invisible ‘silk handkerchief’ over that real Deposit, causing it to ‘disappear’, by falsely describing it as a “Withdrawal”. By magical deception, the “impossible” has been achieved: a real Deposit by Bill has been ‘transformed’ into a fake “Withdrawal” by the Bank, by reversing the positions of the true column headings [“Deposits and Withdrawals”] to show “Withdrawals and Deposits”.3

Falsely recording such a deposit transaction, which causes financial loss to your customer, is a serious offence by the bank, almost certainly criminal.

How many readers (a) recognized this switching of column headings as a potentially criminal fraud, and (b) understood the accounting implications flowing from that two-fold “error”? I’d really like some feedback here. Any commercial lawyers out there? Check your own “loan” account statements and let me know if you find similar “errors”.

LIE No.2 [FIGURE 4, 6]

The second lie in this Asset a/c is the term “Loan Drawdown” in Line 3 of Figure 4. At first glance, this looks like an attempt to withdraw funds from an empty account, a clear breach of RULE 0. But since that a/c was empty (Balance = “0.00”) on 05 FEB, it was impossible to withdraw anything from it.

From the above discussion we know that such a “Drawdown” did not happen (because the entry was in the LH “Debits” column), and now we see that it could not have occurred (as the a/c was empty). But this term “Loan Drawdown” does reinforce the false impression of a ‘withdrawal’, separately created by the reversed column headings.

LIE No.1 (column headings) and LIE No.2 (Transaction Description) thus reinforce each other, creating a more vivid illusion of a “Withdrawal” that did not occur, and would have been a criminal fraud if it were even attempted on an empty account.

Such lies also breach at least three of the ten core principles of the Generally Accepted Accounting Principles (GAAP)4.

Inverting reality is powerful MAGIC indeed!

The Reality

The financial transaction represented by this one number (i.e., the “30,150.00” in the LH “Debits” column) was a Deposit made by Bill, which increased the Bank’s assets from $0.00 to $30,150.00. The positioning of that single number proves:

the bank’s lie: There was no withdrawal from this a/c [RULE 5b: No Credit-item in the RH (Credits) column] and such a withdrawal could not have occurred [RULE 0: Prior Balance = 0.00 ]; and

the accounting truth: A valuable asset was deposited in this a/c [RULE 4a: Debit-item (in LH column [RULE 2]) increases Debit-balance], that deposit was made by Bill and increased the Bank’s assets (i.e., the Debit-balance in the Bank’s Asset a/c).

The Deception

Switching of these column headings and the false Transaction Description are not just untruthful; they mislead and deceive. The Bank falsely implied (i) that a “Withdrawal” did occur, (ii) that this illusory “Withdrawal” was made by the Bank to fund an equally illusory “Loan Drawdown”, and (iii) that the “loan funds” originated from the Bank’s assets.

Since “no funds existed” in that account (prior to Bill’s deposit) and “none were ever withdrawn”, whether there ever was a “loan” by the bank is a fair question which we need to analyze further. But I have still more evidence to show you on the second page, so I’ll come back to that point later. Let’s first see what evidence appears in the Liability a/c.

“Errors” in Bank’s Liability a/c

[see Figures 5, 7]

The “Transaction Description” in Figure 5, (reproduced here in Figure 7) states “Proceeds of Loan Drawdown from” (red) “6XXX-XX142” (green), and “30,000.00” is posted under the RH Credit-column heading, “Deposits” (red).

First, check that the number 6XXX-XX142 (green) is the number of the Bank Asset a/c in Figures 2, 4 & 6 above and you’ll see that it is.

The Same Lie, Reinforced Again

Further reinforcing the false Bank “narrative”, described above as LIE No.1 and LIE No.2, this Transaction description is another false statement in every particular. As we saw above, there was no “Loan Drawdown” and this “30,000.00” credit-item was not (and could not be) the “proceeds” of a FAKE withdrawal from the empty Asset account.

Now add, The “Deposit” Deception

Placing “30,000.00” under the RH (Credits) column, headed “Deposits”, makes it appear that a “$30,000.00 Deposit” was made by the Bank, following a sham “withdrawal” from the Bank’s own Assets, further reinforcing the earlier deceptions.

But that “30,000.00” - which the ANZ Bank calls a “Deposit” by its placement under that column heading - was not a “Deposit” - by ANYONE. Neither was it the “proceeds” of either a “withdrawal”, or the result of a mythical “funds transfer”, from their empty asset a/c, as the Bank’s words imply.

The Reality

Quite simply, that “30,000.00” credit-item is one of the two credit-items - the other representing the $150.00 ‘fee’ payment - both of which were required to match the 30,150.00 debit-item in the asset a/c under the Double-Entry Matching Principle.5

That “30,000.00” credit-item represents the obligation the Bank undertook in the “loan” agreement, viz., to pay-out the “loan” funds.

It only partially matches the “30,150.00 Dr-item” representing the obligation Bill undertook in the same agreement, viz., to “repay a $30,000 loan and pay a $150 fee”, because the ‘unbalance’ of “150.00” goes to the bank as the ‘fee’ in some other account and is of no interest to us here.

“La Grande Illusion”

This is our first encounter with the matching principle, and here we are witnessing the ANZ Bank’s greatest magical feat: its successful transformation of these visible double-entry facts into a mythical ‘funds transfer’ illusion.

This is pure magic, a “Grand Illusion” in a class of which Harry Houdini might be proud, like his “Impossible Escape” routines; for a gullible audience, it’s both completely convincing and utterly incredible at the same time.

This is how “Money” in the form of “Credit” is made to suddenly appear, apparently from nowhere! This is the great illusion by which the world is currently entranced. This “Grand Illusion” of a “funds transfer” also recurs in following articles where I deconstruct “loan accounts” of other “lenders”.

“La Grande Illusion” is often described by ‘economic experts’ as “creating money out of nothing” or “creating credit out of thin air”. For example, in his 2014 peer-reviewed academic blockbuster6, Prof. Richard Werner, BSc (Econ), D.Phil. (Oxon), called it “fairy dust”, though he later admitted in 2022 that the accounting process “looks fraudulent”.

The IMPOSSIBLE Transfer of “Loan Drawdown … Proceeds”

Although this implied funds transfer from Asset to Liability a/c, i.e., the “Proceeds of Loan Drawdown …” might seem plausible, such a transfer is not simply impossible; it would make no commercial sense to even attempt it.

This false Transaction Description is EVIDENCE of a grand magical deception which is almost completely invisible.7

To grasp how deceptive it is, understand the difference between what the Bank is falsely implying here (i.e., an impossible “funds transfer”) and what it’s actually doing (i.e., recording the required matching entries for a customer’s deposit in its DE bookkeeping).

To help you see this deception for what it is, I’ll outline the accounting entries I’d expect to see IF such a “transfer of funds” were to be attempted in “reality”, and the weird consequences of it. The impossibility of completing the process will be apparent as I proceed and you will soon know that no such transfer occurred (or could ever have occurred).

A real “funds transfer” of $30,000.00 from Asset a/c to Liability a/c cannot even begin unless the bank first records a “$30,000.00 withdrawal” from its Asset a/c, as a “$30,000.00 Credit-item in the RH (Credits) column of that a/c”, reducing the Bank’s assets.8

By the matching principle, the bank must record a matching “$30,000.00 Debit-item in the LH (Debits) column of its Liability a/c”.9

Despite neither of those events happening, IF any such Debit-item were recorded in the Bank’s Liability a/c, it would represent a criminal “loss” to Bill and a corresponding “benefit” to the Bank (a reduction in the Bank’s liabilities [Rule 4b]). Instead of “providing new credit” to Bill it would “decrease any credit” which was previously available to him.

But, as with the Asset a/c previously, this Liability a/c also starts out empty, so the Bank had no liability to Bill, and there is no sensible commercial reason for the bank ever to make that withdrawal, which would force it to post that Debit-item in its Liability a/c.10

To focus on the criminality of this hypothetical debit transaction:

If there were funds in this Liability a/c, they would belong to Bill (as Creditor) and such a debit-item would be “an unauthorized bank withdrawal of Bill’s funds” - amounting to theft!

Alternatively, since the a/c was actually empty11, the Debit-item could also be seen as an attempted ‘withdrawal’ from an EMPTY Liability a/c - which would breach RULE 0 and be an attempted fraud (as well as theft), just as it would be if Bill himself tried to withdraw funds when his Credit-balance was ZERO!

But, the final accounting effect of that implied ‘withdrawal’ and ‘transfer’ would simply be to reduce the Bank’s liability to Bill ‘below zero’; it would change a “$0.00 Credit-balance” into a “$30,000.00 Debit-balance” and the Liability a/c would be transformed into another Bank Asset a/c.12

Illogical AND Impossible

There is no discernible reason for the ANZ Bank to “withdraw and transfer” its own funds in this way. Why ‘pay out’ its own assets to fraudulently reduce the balance of its empty Liability a/c? This would only result in a new bank asset of $30,000! (i.e., an additional $30,000 liability for Bill). Instead of Bill having “$30,000 of credit” as his new asset (in the Bank’s liability a/c), the Bank would have created an additional $30,000 liability for Bill; the “credit” available to him would be exactly “NIL” and his liability to the Bank would jump from $30,150.00 to $60,150.

A very peculiar end result for a supposed “loan of $30,000 credit”.

So let’s have no more talk of this “Proceeds of Loan Drawdown” or “funds transfer” nonsense - a double-entry is a double-entry.

See the “trick”; shatter the illusion!

Clues to look for …

If, on the first page of your Loan Account statement [Statement No.1], you see “Withdrawals” on the LH column, or in the first lines, the word “Drawdown” in the Transaction description, they are clues to start asking serious accounting questions. But please, learn those accounting rules before you do that.

As plausible as “The Bank’s Story” I related above may seem, it simply does not work unless this IMPOSSIBLE transfer of the “Proceeds of Loan Drawdown” is included in the Bank’s “narrative”.

If the ANZ Bank is forced to admit there was a double-entry matching process, and NOT a ‘funds transfer’ from its Asset a/c to its Liability a/c, then its narrative collapses. It has to admit to the false column headings and both false transaction descriptions I’ve identified here.

But it does appear that the same (or a similar) false “narrative” has been running globally, i.e., in all banks. That is what these falsified account entries are starting to suggest.

This is the ugly reality of “credit-creation” by banks.

There are many questions to ask about this evidence, not least being, “Was there a loan here or not?” As no asset was transferred from the ANZ Bank to Bill, was a DEBT established? Did Bill ever OWE the Bank $30,150.00? If so … Why? and If not … Why not? Also, were these “errors” Honest (or Accidental) Mistakes or Deliberate Deception.

I’ll put off discussing such ‘consequences’ for now, because I want to show you two more examples of “loan” account statements from other ‘lenders’, each with new twists on how this “trick” is presented, as well as some very silly “accounting oddities”. Please be patient until after you’ve seen the additional evidence from those two articles.

As more and more people come to see how this “trick” is performed, and how to recognize the evidence of it, so will the force to explode their “credit-creation” illusion be that much stronger, so please share this information as you see fit.

Let me know in Comments if any aspect of this evidence is not clear. If you see a mistake, I also want to know about that, so I can correct it.

If you like what you’ve seen here so far, please share it. The more people who understand what bankers are actually doing, the sooner we regain a correct relationship with them and with our credit (i.e. as Creditors).

I’m not charging for access to this information at present but your free subscriptions do give me useful feedback and as a free subscriber you won’t miss future revelations about other “lenders”.

I should emphasize here that the accounting is correct, as far as positioning of the numbers is concerned. The bank can point to this fact if challenged, saying “Look, our numbers are correctly positioned”. Which is TRUE.

ac·count; [uh-kount] noun 1. “an oral or written description of particular events or situations; narrative:” [source: Dictionary.com]

The legal term for this ‘transformation’ from a real Deposit by Bill into a fake “Withdrawal” by the Bank is “conversion”, which simply means “theft”.

There are 10 Principles of GAAP: 1. Regularity; 2. Consistency; 3. Sincerity; 4. Permanence of Methods; 5. Non-Compensation; 6. Prudence; 7. Continuity; 8. Periodicity; 9. Materiality; and 10. Utmost Good Faith.

Those three items, together - the 30,150 debit and the 30,000 & 150 credits - record the effects of the single $30,150.00 deposit transaction, viz., the acceptance by the bank of Bill’s “Loan Agreement” as a new deposit, treated as a negotiable instrument, and worth its face value of $30,150.00.

Werner R. A. (2014a); Can banks individually create money out of nothing? — The theories and the empirical evidence; International Review of Financial Analysis 36 (2014) at p.16; http://dx.doi.org/10.1016/j.irfa.2014.07.015

Unless you understand the rules of accounting.

This didn’t happen! A Debit-item was recorded in LH (Debits) column instead and bank assets increased.

This didn’t happen either! A Credit-item was entered in RH (Credits) column instead.

And there is no other logical place to put it.

… and Bill hadn’t granted the Bank an ‘overdraft facility’ on ‘his’ Access account.

Since a Bank asset a/c is also Bill’s liability a/c, the bank is thereby placing Bill even deeper in debt - effectively doubling his liability!

I think there's a problem with terminology here. Consider Bill's claim:

"why did you put “Withdrawals” on the LH column, above my $30,150 deposit? That should be “Deposits”, not “Withdrawals”. That transaction represents the value of the loan agreement I deposited in the Bank, doesn’t it?"

To deposit with a bank means to hand *cash* to the bank, in exchange for the bank crediting your account. Bill didn't hand over any cash at all: he just wrote a promissory note. Therefore Bill didn't deposit anything.

The statements are presented as though Bill has (1) withdrawn $30,150 of cash from a new account with an overdraft facility, (2) paid $150 cash to the bank as a fee, and (3) deposited the remaining $30,000 into the access advantage account. Let's look at the effects of each on the bank's (A)ssets, (L)iabilities and (E)quity:

(1)

A: - $30,150 (cash); + $30,150 (Bill)

(2)

A: + $150 (cash)

E: + $150 (fee - Bill)

(3)

A: + $30,000 (cash)

L: + $30,000 (deposit - Bill)

Notice that the changes to the bank's cash position cancel each other out, leaving just:

A: + $30,150 (Bill)

L: + $30,000 (deposit - Bill)

E: + $150 (fee - Bill)

All in all, that seems perfectly reasonable to me.

A question for you, without getting into the details of terminology and accounting rules.

Would you say that this arrangement with the bank allowed Bill to buy $30,000 of goods and services in the short term, in exchange for paying the bank $30,150 plus interest (and late payment fees) in the longer term?